Bitcoin Market Cycle Current Stage

Should you buy the dip or sell the denial?

Quick take;

Despite bullish developments, the bearish medium-term market dynamics persist

Investors appear to be in a state of denial with widespread proclamations of HODL

Anticipating further downside movements before bullish market dynamics return

Disclaimer: Nothing in this piece is financial advice. It is strictly educational information. Take responsibility for your own financial decisions.

We work with top-5 derivatives exchange ByBit as affiliate partners. Use our link and get up to $1,000 as a signing bonus.

Do you want a weekly newsletter like this for your business with no effort on your part? Reach out via email, Telegram, or direct message on Twitter?

It’s been a while. I have been entirely tied up with client work for roughly the past year. Nonetheless, I have more free time to focus on market analysis now and I intend to publish here more frequently. I may have some exciting projects in the pipeline so watch this space and subscribe. Let’s push past the niceties and jump into an analysis of current Bitcoin market dynamics.

It’s hard to deny that the current medium-term Bitcoin trend is downwards. El Salvador was extremely bullish news and Bitcoin couldn’t even manage to break the previous lower high on the daily chart. Bitcoiners have been pumping the bullish development for every cent it is worth but BTC nonetheless is struggling to break the bearish trend that has been firmly in place since the second week of May. A daily price jump of 12% was the result of all of the bullishness and craze surrounding the Bitcoin 2021 conference but the jump failed to break the trend and was on volume that was lower than the 180-day moving average.

(Source: Tradingview.com)

I am personally using the jump to enter a leveraged short position at more attractive risk-to-reward ratios. I will be looking to take profit in the low $30k while I will exit at a loss closely above $40k in the case that the market rises from here. I have been heavily long Bitcoin long-term but I always seek to capitalize on potential downward price movements by taking leveraged positions in the derivatives market.

Simply analyzing past price movements is ultimately a rudimentary form of analysis. It needs to be taken into consideration within the context of a wider framework. What institutions and retail are doing is one of the strongest signals that indicate where the market may be moving. I decreased my Bitcoin exposure early in May as three noobs told me about the crazy risk they were taking in the market within a short timeframe.

That indicated to me that the market was overheated. Those with little experience were taking excessive risk, suggesting that the market was overleveraged and that retail capital was almost fully allocated. The market could have easily kept rising from there as it tends to heavily overextend during euphoric phases. However, it didn’t and decreasing exposure turned out to be the smart call.

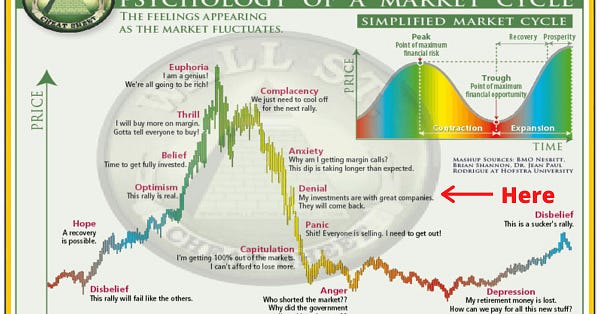

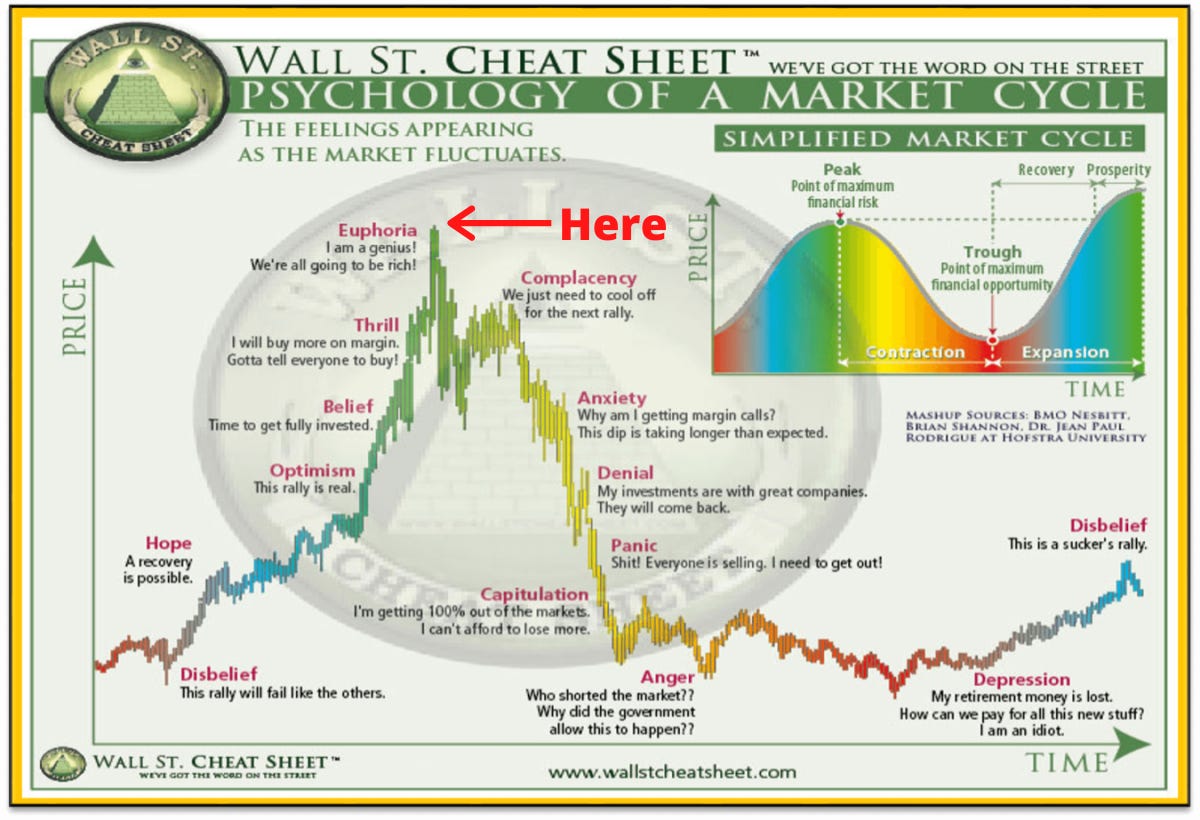

Where in the market cycle are we now? I could be wrong and Bitcoin could go on a tear but the recent sentiment appears to be characteristic of denial. The Miami Bitcoin 2021 conference has just taken place and the only thing that outshone the anticipation of the event was the antics that took place at it.

The event was swarmed with outlandish proclamations of HODL and BTD. The bullish announcement of El Salvador accepting Bitcoin as legal tender was heavily pushed but the market failed to break prevailing dynamics.

If this analysis is somewhat accurate, the market likely has more room to bleed. I have no intention of increasing my Bitcoin exposure in the near-term. If the market enters territory below $25k, I will reassess and likely start increasing exposure.

On a final note, it is worth noting that institutions are the smart money while us mere mortals can only use the tools at our disposal to try and anticipate movements. However, looking at what institutions are doing is one way of doing this. Interestingly, the Grayscale Bitcoin Trust, the largest Bitcoin exchange-traded product that is mostly traded by institutions, has been seeing very consistent weekly outflows for the past three months.

If you got some value from this release, it would be super amazing if you could like and share the below tweet. It will help us build the newsletter and get our analysis to more people!

About Adaptive Analysis

Adaptive Analysis helps cryptocurrency businesses build audiences and convert prospects into paying customers. Our newsletter product helps businesses build a connection with prospective users with minimum time hassle from their end. If you’re interested in a newsletter like this one for your business, reach out via email, Twitter, or Telegram.

Very good read