Bitcoin Bull Versus Bear Case

Analyzing Bitcoin market conditions amid a lengthy period of consolidation

Quick take;

Bitcoin medium-term downtrend takes a hiatus as strong liquidity lies at both ends of current range

Arguments can be made for both a bullish case and bearish case in Bitcoin

On-chain analysis, strong buyer liquidity, and funding rates have shown some bullish signs

On the other hand, the trend is still downward and price has some significant hurdles to overcome if price is to resume its uptrend

Disclaimer: Nothing in this piece is financial advice. It is strictly educational information. Take responsibility for your own financial decisions.

We work with top-5 derivatives exchange ByBit as affiliate partners. Use our link and get up to $1,000 as a signing bonus.

Bitcoin continues to trade range bound and recent developments have forced me to reassess my previous anticipation that the Bitcoin market has more room to bleed. While this may be the case, I have also come to realize that there are some strong arguments that Bitcoin has already formed its market low.

I am currently neutral in my outlook and hold no directional bias. Both bullish and bearish cases can be made for Bitcoin and I will detail these below. But one thing is for certain. Bitcoin must break the strong liquidity that lies at either end of its current range for greater volatility and volume to return. Many directional and arbitrage traders are currently sitting on the sidelines due to the lack of volatility, further reinforcing the range bound price action.

Before detailing the bullish and bearish arguments, I will reiterate that I am neutral in my outlook. I could see either of these scenarios unfolding and I will await a breakout before I start to take speculative positions. If anything, because price is currently trading closer to the lower end of the range, I allocate slightly higher odds to the bearish case.

The Bull Case

(Source: Tradingview.com)

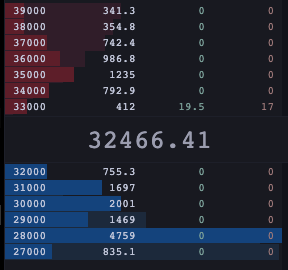

On the lower-end of the current Bitcoin range lies the significant $30k level and the yearly open of $28,923 below it. Naturally, this has attracted significant buyer liquidity. Order book analysis based on data from Tradinglite shows that on the Binance BTCUSDT spot market (the biggest spot market), buy orders of almost 5,000 BTC lie between $28k and $29k alone. Another 5,000 BTC in buy orders lies between $29k and $32k with much thinner liquidity lying between the current price and $40k as illustrated below.

(Source: Tradinglite.com)

A similar scenario is viewed on the orderbook of perpetual futures markets. Here’s the FTX order book, a top-three derivatives exchange by daily trading volume. However, there is more liquidity concentrated close to price in this case which makes sense given the extremely speculative nature of the participants of these markets. However, you don’t need to analyze order books to realize that $28k to $32k is an area of significant interest for buyers. The quick reversal on the 22nd of June as Bitcoin dropped below $30k highlighted that significant buying pressure rested in this area.

(Source: Tradinglite.com)

A deeper analysis of the most recent dump below $30k suggests that it was driven by leveraged traders in the perpetual Bitcoin futures market. Around the time of the 22nd of June dump, the average funding rate in these markets sustained negative territory for over a week, indicating that traders in these markets played a significant role in the downside movements. Given the highly leveraged nature of these markets, price movements driven largely by speculative activity in these markets are more susceptible to a reversal. This was probably the biggest factor that made me reconsider my bearish outlook. If the Bitcoin price is currently approaching another test of $30k, I believe that the average funding rate during this test will be extremely revealing regarding future price prospects.

(Source: research.arcane.no)

One factor which may indicate that the medium-term downtrend is approaching its conclusion is the impact of news on recent price action. It appears that news is having a lesser impact on the Bitcoin market price movements which is characteristic of the latter end of a trend. Consider the Bitcoin price movements in early April and early May. Positive news developments were having little impact as price approached its reversal. Similarly, recent news developments which can be perceived as bearish, such as a significant drop in Bitcoin hashrate, are having a futile impact on price movements. I don’t have solid data for this argument. Any analysts/developers that are interested in doing a more quantitative analysis on the impact of the news on the Bitcoin price cycle, reach out! From a news perspective, it is worth noting that a Bitcoin debate between Jack Dorsey and Elon Musk will take place on July 21st. There is certainly a high possibility that comments from either could have a significant impact on price movements.

Onchain analysis is not my speciality. There is certainly something to it but I tend to think that the majority of the data points that analysts use to assess market conditions are a function of the current price as opposed to vice-versa. However, respected onchain analysts like William Clemente III and Nick from Ecoinmetrics show some reasons to be bullish from the onchain perspective. Onchain data shows that Bitcoin whales (addresses with holdings of over 1k BTC) are beginning to reaccumulate at current prices which would certainly be a strong bullish proponent for future price prospects. I would suggest diving into the original pieces linked above for a better understanding of what is happening onchain.

Given all of the above factors, here’s my take. For the bearish trend to continue, it needs to break through the strong buyer liquidity resting between the current price and $28k. Leveraged trading activity in the perpetual futures market is unlikely to do this sustainably so significant selling pressure needs to be applied in the spot market. Until that happens, the medium-term downtrend is on a hiatus. However, if it does occur, it is likely that the medium-term downtrend will continue and there may be extremely attractive accumulation opportunities between $20k and $28k. With that being said, here are the factors that favor the bear case.

The Bear Case

(Source: Tradingview.com)

There is strong evidence to show that trend is king in the cryptocurrency markets. See here, here, and here. This is slowly changing with a greater share of the market being attributable to institutions but we are still yonks away from trading activity being primarily driven by fundamentals-based valuation models.

With that being said, the trend plays an outsized role in the price prospects of Bitcoin. When the trend reverses, as it did in early May, a myriad of factors start to work in the opposite direction. When the trend is upward, bearish news tends to have a null impact while bullish news can result in significant upside movements. The opposite is true in the case of bearish trends.

On a rudimentary level, areas that were once areas of strong buyer liquidity transition into areas of strong seller liquidity. I foresee two major areas bringing in significant seller liquidity. $39k to $42k has already shown that it has a heavy concentration of sellers. Above this, $49k to $51k will also likely have a heavy concentration. If this level can be overcome, the odds of all-time highs being reclaimed will significantly rise and we will be in a zone that is more favorable to leveraged long trading.

These two pockets of seller liquidity show that price has some significant hurdles to overcome before its upward trend can be continued. We are still deep in the downtrend. Although the trend has entered a momentary hiatus, we certainly have not resumed an uptrend.

Another factor corroborating a bearish outlook is the nature of bottoms. Market bottoms are often associated with points of maximum pain. When I consider the latest bottom, there was little pain. Most maintained their bullish disposition and claimed that the drop was the last time that Bitcoin would drop below $30k. When I see some stronger hands questioning their position, that would indicate to me that the market may be approaching a point of capitulation. It would be interesting to see Bitcoin price drop below MicroStrategy’s average purchase price. Given that MicroStrategy played such an important role in the latest bull cycle, it would likely leave many questioning their investment decisions if their holdings were to turn into negative territory. This would likely be more characteristic of capitulation and would also bring BTC price close to the all-time high of its previous market cycle at $20k.

To sum up, price prospects are uncertain while Bitcoin continues to trade in its current territory. There are arguments to be made from both the bullish and bearish perspective. As I mainly seek alpha from speculating on the trend, I will be waiting for BTC to break its current phase of consolidation before taking further positions. If you enjoyed this piece, it would be a big help if you liked and shared the below tweet.

About Adaptive Analysis

Adaptive Analysis helps cryptocurrency businesses build audiences and convert prospects into paying customers. Our newsletter product helps businesses build a connection with prospective users with minimum time hassle from their end. If you’re interested in a newsletter like this one for your business, reach out via email, Twitter, or Telegram.