Silvergate’s Demise Marks Latest Hurdle for Troubled Crypto Markets

SI faces liquidation as the industry explores alternatives to a major banking partner

Silvergate Bank (NYSE:SI), one of the top two banking partners for cryptocurrency-related businesses, is winding down. With over $11.9 billion in assets at its peak, the bank is the latest victim of the raging crypto winter and perhaps one of the most notable fallouts since the FTX collapse.

Silvergate provided banking infrastructure to crypto heavyweights, including Coinbase, Galaxy Digital, Circle, Crypto.com, Paxos, and others. The bank’s impending closure significantly affects a key payment rail for crypto companies and limits the flow of institutional capital into the industry. Silvergate’s woes also dampen mainstream interest in a space that has been plagued with the worst possible outcomes in the past year.

This week’s Adaptive Analysis Newsletter reviews key events leading up to Silvergate’s crisis and how crypto markets have reacted. Although the cryptocurrency industry is accustomed to dealing with even the most severe black swan events, the path forward may be excruciating as institutional investors seek alternatives in the months ahead.

Silvergate meets death end in crypto banking

California-headquartered Silvergate Bank launched in 1988, backed by holding company Silvergate Capital. The bank attained Federal Reserve bank member status and eventually went public in November 2019 through an IPO on the New York Stock Exchange (NYSE).

Before its IPO, Silvergate had become popular as a crypto-friendly bank. The company opened its doors to crypto way back in 2013, despite the uncertainties facing the nascent industry at the time. That decision led to Silvergate’s meteoric rise, with the bank settling over $219 billion in transfers during the market's peak in late 2021. Yet, the move to service crypto clients has brought the bank to a dead end. Since reaching a new high of $238 per share in October, Silvergate (SI) has suffered a steep decline, further exacerbated by the crypto market crisis and eventual liquidation news.

(Source: TradingView.com)

Silvergate’s woes reportedly began in late 2022 following the crisis at FTX, one of its major crypto clients at the time. The crypto exchange’s collapse triggered a bank run at Silvergate, with customer deposits dropping from $11.9 billion to $3.8 billion (a 68% decline) by the end of the last quarter.

Silvergate had to liquidate $5.2 billion of debt securities and borrowed a further $4.3 billion from the Federal Home Loan Bank to handle the increased withdrawals. The crypto-friendly bank never really recovered from the bank run, posting a $1 billion loss that quarter.

A 40% workforce layoff in January confirmed fears that the company was struggling financially, despite recent investment disclosures from BlackRock and Citadel Securities. The final nail in the coffin came on March 1 when Silvergate announced that it would delay filing the annual 10-K for 2022 to the U.S. SEC. The delay was to let the company address the “viability” of its business.

Since then, Silvergate began the process of sunsetting its business. The bank dissolved its core offering, the Silvergate Exchange Network (SEN), which crypto companies used to settle USD-denominated transactions for their clientele. The network reportedly allowed crypto firms access to 24/7/365 transfers between Silvergate-linked bank accounts, a flexibility not offered by traditional banking partners. Following SEN's closure, Silvergate’s crypto clients are severing ties and have begun searching for an alternative to fill the big void left by the banking firm.

Will stablecoins be the biggest winners in the banking fallout?

The latest development at Silvergate would have provided the perfect catalyst for major competitor Signature Bank to strengthen its position in the market. However, Signature Bank had already begun reducing its exposure to the crypto industry for similar reasons that led to Silvergate's demise. Signature Bank revealed that clients' deposit balances dropped by $826 million between January and February. The bank said the decreasing balance was "driven by the deliberate decline in digital asset client-related deposits of $1.51 billion."

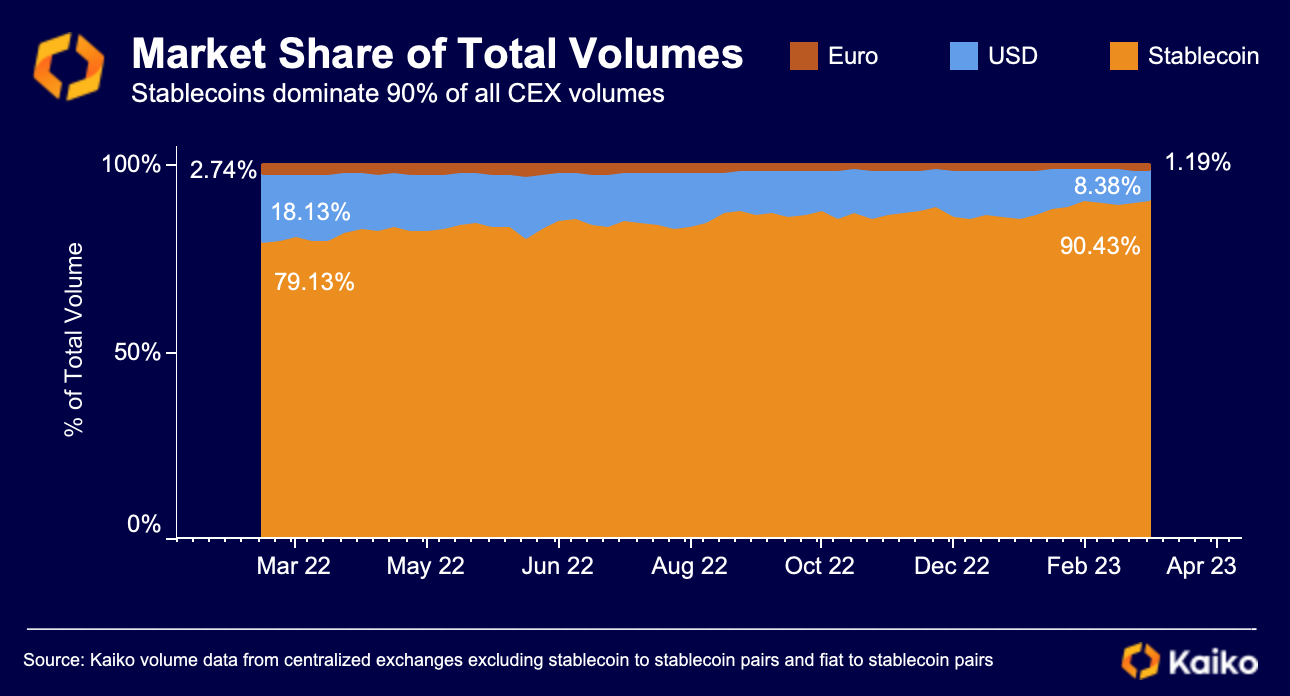

The loss of two major banking partners for the U.S.-based institutions have shaken investor confidence, with the market shedding roughly $87 billion in market capitalization in the past five days. Nonetheless, it could provide a springboard for stablecoins to see increased adoption within the crypto industry. This is already proving true with leading stablecoin Tether (USDT) hitting a new $72 billion market cap high in the aftermath of Silvergate winding down its operations. Stablecoins already account for over 90% of centralized exchange trading volume and will likely take on increased significance in the coming months.

(Source: Kaiko.com)

It goes without saying that stablecoins have had their fair share of uncertainties in recent weeks. Regulatory action against Binance's BUSD stablecoin sparked fresh fears of a crackdown on competitors. Speculations on whether stablecoins constitute securities under U.S. laws remain up in the air, with recent actions against Kraken and Kucoin doing little to abate the rumors.

The path to a broader crypto market recovery remains relatively uncharted after Silvergate's hit. Losing a critical payment rail for institutional investors poses a new kind of challenge that the crypto industry must solve using stablecoins or building new infrastructure to bridge billions from the traditional banking system to the nascent space.

Crypto market spotlight:

U.S. Government moves $1B in bitcoin to Coinbase: On-chain sleuths reported the transfer of $1 billion worth of bitcoins seized from the infamous Silk Road burst to Coinbase. It is unclear whether the unwinding of the confiscated assets contributed to the recent crypto market drop.

Yuga Labs raises $16M from selling Bitcoin-based NFTs: Popular NFT studio Yuga Labs raised $16 million from auctioning its latest TwelveFold NFT collection released in the Bitcoin blockchain

FTX reports over $8.9B in customer funds missing: In a recent public presentation, FTX's new managers confirmed the exact amount of missing customer funds – a whopping $8.9 billion.

Biden budget proposes a 30% tax on crypto mining electricity: A surprise inclusion in the recent budget proposal by U.S. President Joe Biden is imposing a 30% tax on electricity used for crypto mining operations.

Brazil begins CBDC pilot program: The South American nation is the latest to launch a central bank digital currency initiative. According to the Brazilian central bank, the new "digital real" will serve various retail-focused use cases.

If you like this release, give it some fuel by liking or sharing the below tweet.

About Adaptive Analysis

Adaptive Analysis is a B2B content marketing company that helps technical enterprises produce and promote content in a mass appealable way. Our white-label content has been featured in major media outlets such as Yahoo, Bloomberg, Nasdaq, and Coindesk. We have worked with major brands in the cryptocurrency industry, including Blockworks and Compass Mining. Reach out to the team today to schedule a content strategy call.