March 2020 BTC Analysis - Coronavirus Catalyzes Global Economic Crisis

BTC Price Tanks As World Rushes For Liquidity Amid Global Economic Crisis

Disclaimer: The information presented does not represent financial or investment advice. You are responsible for your own financial decisions. Read the full disclaimer here.

Analysts have been forecasting a global economic crisis for several years. Extraordinarily high valuations in almost all asset classes, extreme debt-to-GDP levels, experimentative monetary policy, a yield curve inversion, and NIRP were all excellent reasons why speculators were expecting a financial crisis.

But generally, when it comes to market analysis, you can’t say “X, therefore Y”. An economic crisis or shock needs to be something unforeseeable.

For the past decade, macroeconomic variables have been logically setting up for a downturn. But the market does not function based on logic.

It works like a massive betting machine where everybody collectively determines the odds in proportion to their capital allocation. Coronavirus was the perfect catalyst to burst what had clearly become an unstable market environment.

Join for monthly market insights. It’s free and you can unsubscribe at any time.

Global Markets Tank - Deleveraging of Debt

Trillions of dollars are evaporating. The biggest equity indices are in freefall.

And rightly so… countless debt-fuelled businesses worldwide have come to a standstill, most consumers also loaded with debt and vulnerable income prospects will have halted purchasing, and credit conditions have taken a strange turn.

Here’s how investor sentiment is looking using the CNN Fear and Greed Index as a proxy. We have moved from near 100 (extreme greed) at the start of 2020 to a score of 3 one week ago.

For the past decade, many businesses have only been able to operate just above the margin due to easy access to credit, extremely high consumer confidence, and monetary stimulus. In such times, these businesses barely survive and are known as Zombie companies.

Such companies remain reliant on a steady income from confident consumers to meet their debt expenses and keep their heads above water. With all these factors suddenly and drastically changing, these businesses and more can be expected to be wiped out.

A natural survival of the fittest has sparked and only the strongest businesses will remain. Central banks worldwide are taking extreme measures to try and alleviate what will certainly be a global economic crisis. Here are some of the highlights;

Federal Reserve cuts interest rates to a range of 0% to 0.25%

Both the Federal Reserve and ECB ramp up quantitative easing.

The Federal Reserve implements untested experimentative measures such as issuing loans which do not need to be repaid and removing the fractional from fractional reserve banking.

The Central Bank of China carries out a long list of monetary stimulus measures

The summary is central banks globally are dropping rates, injecting boundless stimulus into the economy in an attempt to alleviate the global economic crisis, and trying untested experiments. A Federal Reserve President demonstrates that the biggest central bank in the world is willing to go to boundless limits to address the financial crisis.

“There’s an infinite amount of cash at the Federal Reserve.”

Neel Kashkari, Minneapolis Federal Reserve Bank President

This economic crisis impacts almost every type and size of business. Large and mid-sized enterprises that were operating just below margins will be unable to meet costs.

The freelancer economy will be impacted as businesses need to tighten up budget. Budgets which could have before been spent on things like “brand strategy” and “online coaching seminars” will evaporate.

The harsh reality is many businesses won’t survive. Businesses often get wiped out by changing circumstances in rising markets.

Now we have a global health pandemic destroying consumer confidence and asset valuations in freefall. The clear picture is only the strongest enterprises will survive.

We will also likely see a mass change in the ownership of assets. Valuable businesses that fail to meet costs will be picked up for pennies on the dollar. Investors with large amounts of cash will have a funfair building long-term stock positions.

BTC Analysis - Rush for Liquidity Sparks Bitcoin Decline

Bitcoin’s distributed design and PoW incentive system means that it exercises a high degree of resistance against:

A change in its monetary properties,

Coercing or bribing sufficient computing power to alter the ledger and execute double-spend attacks,

Censoring transactions.

But when it comes to BTC price, the market will ultimately set it. Many were shocked to see BTC price decline as the coronavirus crisis unfolded.

Prevailing narratives about Bitcoin being a safe haven, an uncorrelated financial asset, and a digital gold all went out the window. Because they are just that… prevailing narratives.

Narratives do not set the price. Market participants who bet with their capital do.

As Bitcoin price dropped in sync with equities, many have replaced their narratives with explanations that BTC is a risk-on asset. But this is simply another narrative which can easily be displaced by future market dynamics.

As the coronavirus exacerbated and the market began to recognize that a global economic crisis was approaching, the market needed liquidity. Risk-on assets including equities and Bitcoin tanked and some capital was transitioned into fixed income and gold.

Does this mean that Bitcoin is a risk-on asset and will always decline as the market rushes for liquidity? Certainly not, Bitcoin has inherently different properties than equities and market dynamics are consistently subject to change.

BTC Technical Analysis - Retail is Always Wrong

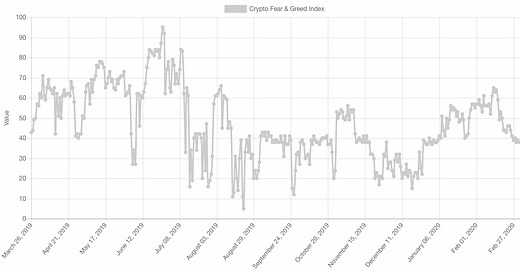

Sentiment in the BTC market has also been scraping the bottom of the barrel. For the past week, the Crypto Greed and Fear Index scores have ranged from 8 to 12.

When it comes to speculating on BTC price movements, “retail is always wrong” is a useful general rule-of-thumb to bear in mind. In recent market conditions, analysing the direction institutions and retail are betting has been indicative of future price movements.

Before Bitcoin depreciated over 50% in the space of just a few days, data from the CME CoT report illustrated that institutional traders had speculative positions which highlighted that they were almost as bearish as they have been at any point historically. The only point where they were more bearish was the week preceding the Bitcoin decline when price traded even higher ~$10,000.

At the same time, data from the CME CoT showed that retail traders were decisively bullish. Furthermore, the positive BitMEX funding rate showed that the majority of market participants were leveraged long in the BitMEX perpetual BTCUSD market, the actively traded BTCUSD derivative market.

After the decline of >50%, the tables turned. The past two CME CoT reports have shown that institutions are significantly more bullish in their positions while retail turned bearish in their outlook at the local low.

The daily chart of BTC has since been forming a textbook uptrend. Whether the Bitcoin uptrend continues is debatable and needs to be informed with other data but the recent market dynamics highlight the disproportionate impact that large capital holders have on market direction.

Bitcoin Research Recommendations

Blockware Solutions, a North American ASIC hardware procurer and Bitcoin mining pool, released proprietary research to the public which analyses the impact Bitcoin miners have on market dynamics.

A widely proliferated theory is that the market-wide average cost of production will act as a point of support for Bitcoin bottoms. But sharp declines in the price of BTC resulted in values going beneath both the market-wide cost of production and the estimated electricity cost per BTC mined.

Blockware shared research that highlights how points of miner capitulation are closely associated with BTC price bottoms. In reality, BTC price approaching mining cost of production accelerates selling pressure.

It is not until the inefficient miners go bankrupt by selling 100% of their mined BTC plus depleting Bitcoin reserves that a favourable difficulty adjustment will occur and the efficient miners that remain set the foundations for healthier BTC market dynamics. For the tldr, check out this tweetstorm from Blockware CEO Matt D’Souza.

Matt also shared one of the rare equities outperforming in current conditions. Video conferencing company Zoom is one of the few leading America software providers that is not banned in China.

The global shutdown caused by Coronavirus has forced employees to work from home. Many business owners may now begin to consider remote options as they offer the potential to drastically reduce overhead.

I am aware of a business owner in Sydney who is attempting to exit a $50k per month office lease after realising that his team can operate effectively while working remotely. Businesses and software providers catering to remote organizations open up an interesting investment angle to consider for current market conditions.

My Parting Two Satoshis

I have spoken with several individuals and businesses who have been really hurt by the depreciation in the USD value of Bitcoin. While it’s nice to fantasize about Bitcoin continuously increasing in value and eventually challenging the dominance of fiat money, the harsh reality is the vast majority still need to meet their expenses in fiat.

The design of the Bitcoin network makes it an enticing asset class to get exposure to. And that’s the very reason that many have been hurt by this downturn.

Despite the price drop, the promises of the technology are still intact. The censorship-resistance and fixed inflation schedule are still maintained by computing power whose incentives are aligned to act for the long-term health of the network.

However, the short-term pressure on those who left themselves overexposed will inevitably wipe some businesses and individuals out. Such is the nature of evolution and of markets.

In retrospect, it is easy to say that those who keep the majority of their capital in Bitcoin were taking reckless risks. But such is the capital that has recognized the promises of the Bitcoin technology and is willing to take the risk to speculate on its long-term success.

Furthermore, the nonlinear nature of returns will reward those who allocate maximally to the best performer. Rebalancing and Modern Portfolio Schmeory simply doesn’t cut it in a world where the winner captures all.

“For should the enemy strengthen his van, he will weaken his rear; should he strengthen his rear, he will weaken his van; should he strenghten his left, he will weaken his right, should he strenghten his right, he will weaken his left. If he send reinforcements everywhere, he will everywhere be weak.”

Sun Tzu, The Art of War

-John

Interested in partnering with or sponsoring these monthly market releases. Get in touch via email or Twitter.

About Adaptive Analysis

Adaptive Analysis is a content strategy agency for crypto and finance businesses. We help businesses drive traffic to their website, improve their SEO, and establish their brand as an authority in its field. Get in touch through Twitter or email.