How will Bitcoin Behave if the Global Economy Erupts?

You can also read this blog post on the Adaptive Analysis website.

Economic conditions become increasingly turbulent after a decade of stimulative monetary policy & negative interest rate policies. A forward-looking indicator which has preceded every recession since the 1950s has recently signalled that a recession is in store. The limited evidence we have suggests Bitcoin has little downside risk in the event of an economic crisis.

Important Disclaimer: Nothing here should be constituted as financial advice. It also should be noted that the writer has upside exposure to Bitcoin, leading to all sorts of biases and degenerative opinions.

When respected global macro traders speak, it’s time to listen. These traders have what is known as “skin in the game”, a concept Nassim Taleb wrote an entire book on. The outlooks of global macro traders are closely tied to their wealth whereas the outlook of a politician, economist, or slickly suited banker is much more closely tied with matters such as election cycles, year-end bonuses, and public relations.

Recently, two highly respected global macro traders have shared their thoughts on how the global economy is shaping up. Ray Dalio published a 45-page report titled “Paradigm Shifts”, in which he analyses the major economic shifts in the United States over the past century along with a tentative forecast on how he believes the next decade is shaping up.

The other trader, Raoul Pal, published two monster threads, one detailing the wobbly legs the global economy is standing on and another highlighting the shaky state of the currency market. The economy has experienced enormous growth since the last recession. How much of this growth is due to real increases in productivity, as opposed to experimentative monetary policy, remains unknown. Regardless, the latest data indicates that we may be on the verge of another global crisis and the outlooks of Dalio and Pal are worth pondering.

This post details the latest economic developments along with some speculative outlooks on what this might mean for Bitcoin. How Bitcoin will behave as an asset in times of economic turbulence has been a highly speculated subject. One of the most common claims is that Bitcoin will outperform due to its strong store-of-value properties. This popular narrative compares Bitcoin to physical gold and uses this as a foundation to support the theory that Bitcoin will perform positively in times of economic turbulence. The fact is we have limited empirical evidence indicating how Bitcoin will behave if an economic crisis takes place. We explore some scenarios to how Bitcoin may behave by cross-examining the data we have on Bitcoin with the characteristics of how markets have behaved during previous recessions.

If you are just interested in how Bitcoin may behave in if a recession hits, skip to the “How will Bitcoin Behave?” section. You can also see the movements of Bitcoin when the Renminbi devalued in the “Currency Crisis” section.

Economic Developments

The dim outlooks many currently hold regarding the state of the global economy has a strong foundation in the data. The fourth-biggest economy in the world, Germany, is on the verge of recession after its gross domestic product (GDP) contracted 0.1% last quarter. GDP is essentially the income produced within a country’s borders. Two consecutive quarters of contraction and a country has officially entered a recession. China, the second-biggest economy in the world, has also been reporting weaker than expected growth.

However, GDP is a lagging indicator. The data is sent after-the-fact. The forward-looking indicators for other major economies are not looking any better. The yield of the 10-year Treasury bond has recently dropped below the yield of the US 2-year Treasury bond. This phenomenon has preceded every recession since the 1950s.

Premium of the US 10-Year Treasury Bond Yield Above the US 2-Year Treasury Bond Yield; Source: TradingView.com

The last time the 2-year yield rose above the 10-year yield was July 2007 before the Great Recession of 2008. Longer-term bonds typically have higher yields than shorter-term bonds. The longer-term yields dropping below shorter-term yield is representative of investors holding more pessimistic outlooks for economic conditions. In response to this, investors drive up the price of longer-term bonds as they look to park capital in safer assets. Given that investors in the US bond market include investors of all sizes globally, the curve is a good gauge of the global expectations of how the US economy is going to perform.

“Everyone invests in the US Treasury market from the Chinese central bank to pension funds in Canada and Europe, hedge funds in America. Everyone is exposed to and invests in the US Treasury market. So if you’re looking for an aggregate opinion of everyone in the world, what they think might happen to the US economy, and by extension the global economy, you would be very hard-pressed to find something more important to look at.”

Alice Fulwood, The Economist

The United States is not the only economy where this is occurring. The yields of the 10-year bonds and 2-year bonds issued by the UK government have also inverted. Some fixed income analysts question whether the inversion still holds its power of predicting future recessions. However, most still consider it the strongest signal we have of an impending recession. However, the question of how long there is between a curve inversion and an actual recession is debatable. This has ranged from 8 to 24 months after each yield curve inversion since 1956.

Currency Crisis

Another major theme of the recent economic turbulence has been the instability of currency valuations. Several countries have devalued their currencies as they seek to reduce debt burdens and improve exports.

The PBOC, the central bank of China, devalued the onshore Renminbi above 7 per USD on August 5th shortly after a 10% tariff on $300 billion of Chinese imported goods was threatened by the US government. Trump quickly labelled China a “currency manipulator” after the devaluation.

The offshore Renminbi devalued even further against the USD. As the Renminbi depreciated against USD, bitcoin appreciated. Observe the performance of the two on the chart below when the onshore peg was set above 7 on August 5th.

Offshore Renminbi (CNH) versus USD in blue and Bitcoin versus USD in red, Source: Tradingview.com

The strict capital controls of the Chinese government combined with the devaluation of the Renminbi against the USD strengthens the value proposition of the permissionless and censorship resistance features of Bitcoin. As the yuan devalues, so does the wealth of Chinese citizens who are forced to hold the vast majority of their wealth in this fiat currency.

“Capital controls, inflation and capital flight have always proved to be significant medium-term drivers of the bitcoin price, as early as the 2013 Cyprus banking crisis.”

Tuur Demeester

The fiat currencies of a long list of other countries have long been struggling to maintain their purchasing power. Argentinian and Venezuelan citizens have had their wealth rapidly eroded from extreme inflation. Raoul Pal highlights that many other currencies look to be on the brink of massive devaluation when compared to the USD.

Another point on the note of currencies is the position of the USD as the reserve currency of the world. The Bretton Woods agreement effectively placed the USD into the position of the reserve currency of the world meaning that economic activity worldwide would be predominantly conducted in terms of USD. This status still stands today with the majority of central bank reserves being in USD. However, its position as a world reserve currency has become weaker as the US share of global growth declines and the percentage of central bank reserves held in USD declines.

Even the Fed chairman, Jerome Powell, admitted before Congress that the world reserve currency status is not something which will last forever. Extremely candid words from the man spearheading the world’s greatest fugazi that all value should be denominated in USD.

“You’ve got to be running a fiscal sustainable policy and we’re not... I don’t think in the near term there is anything to threaten our status as reserve currency but in the medium and longer-term we’ll have to address our fiscal issues”

Jerome Powell, Fed Chairman

JP Morgan Asset Management has also taken note of the questionable position of the USD as the world’s reserve currency. They are recommending their clients to diversify exposure away from USD by holding a basket of fiat currencies and precious metals.

“There is nothing to suggest that the dollar dominance should remain in perpetuity. In fact, the dominant international currency has changed many times throughout history going back thousands of years as the world’s economic center has shifted.”

Craig Cohen, JP Morgan

Monetary Outlook

“If the whole world decides all at the same time that this quantitative easing while simultaneously running massive deficits on top of increasingly untenable debt level is not a great idea and we need a little bit of a hedge on that, there’s not enough [bitcoin] to go around”

Travis Kling

Monetary policy has been one of the craziest aspects of the global economy over the past decade. It has been characterized by aggressive easing measures. Major central banks have injected huge quantities of cash into economies to stimulate growth and most central banks have been forced to lower interest rates to 0% or even negative territories to tackle deflation. There is almost $17 trillion in negative-yielding debt circulating worldwide which means investors are paying to put their money in these debt instruments. You certainly don’t need to be an economist to question how sustainable such a jig is.

The Federal Reserve, European Central Bank (ECB), and the Bank of Japan (BoJ) have all drastically increased the size of their balance sheets over the past decade through quantitative easing. Quantitative easing simply means printing money and injecting it into economies. This typically consists of central banks purchasing government bonds but can also consist of the central banks purchasing corporate bonds and other instruments such as equities. The BoJ today owns over 75% of Japanese ETFs and almost half of the government’s debt. If the BoJ begins to write off the debt that they owe to themselves, it could potentially cause huge disruption in their domestic currency and the welfare of their country.

Quantitative easing and lowering interest rates are two powerful tools that central banks have at their disposal when trying to stimulate the economy. However, interest rates are already at-bottom or near-bottom and the balance sheets of central banks have already drastically increased since the last recession. Further decreases in interest rates and/or more quantitative easing look highly likely to wreak havoc on the global economy. If interest rates continue to decline, a point will be reached where debt is no longer attractive to hold as an asset as the yield drops below non-productive assets and cash. This could catalyze mass-selling in the fixed income market and wreak havoc on institutions such as pension funds whose balance sheets are loaded with such instruments. The fixed income market already appears to be approaching the brink with the $17 trillion in negative-yielding debt having less of a yield than just holding cash. How far holders of such debt instruments are willing to let yields drop is unknown.

The lowering of interest rates also serves to make debt easy to take on. This spurs excessive borrowing and debt-fueled purchases. Governments run huge fiscal deficits and corporations execute large share buyback programmes. Travis Kling has described it as “Universal Basic Income for the rich”. Dalio is concerned about the social unrest it creates between the wealthy and the lower classes. The wealth disparity between those who own assets and those who do not significantly widened as a result of the debt-fuelled purchases.

The lowering of interest rates also serves to drive down the expected returns of risky assets. Each asset has a return premium to represent its riskiness. Cash and non-income producing assets such as metals have no productive return, bonds will mostly have a small return above cash, while equities and other risky instruments will have a higher return again. Debt-fueled purchases serve to drive the prices of risky assets up and their future expected returns down. We are already seeing the returns of bonds drop below cash in the negative yield cases. Currently, the markets are pricing in high expected future returns of instruments such as equities but as growth concerns and lower than expected earnings mount, there is a high possibility of a rapid reversal in expectations. When the expected returns are knocked out of equilibrium, a devaluation will typically need to occur putting pressure on businesses and investors who hold leveraged long positions on artificially inflated assets. The diagram below from Dalio’s Paradigm Shifts illustrates the relationship between interest rates and the future returns of assets.

Relationship between interest rates, asset prices, and expected future returns; Source: Paradigm Shifts

How will Bitcoin Behave?

The executive summary up to this point is that the current state of the global economy is shaping up to be extremely fragile. Key equilibrium points are being knocked out of balance. Central banks and the economies in the world are operating in an unsustainable manner. The equity markets and bond markets seem to be in an extremely vulnerable position as a result of highly experimentative monetary policy and huge fiscal deficits being taken on by the countries with the largest economies.

How Bitcoin will perform if the global economy takes a turn for the worse is a question which many have considered. To date, it is nothing more than a matter of speculation given that the asset has never existed in times of economic turbulence. The empirical evidence to draw upon is limited. There are several popular narratives tied to how this asset might perform in response to economic downturns. We explore some of these narratives and also draw upon what we know about the Bitcoin network and its procurers and users to derive some possibilities regarding how the asset may behave in times of economic turbulence.

Bitcoin’s Digital Gold Narrative

Bitcoin’s fixed inflation schedule has led many to tie the asset to a digital gold or safe haven narrative. The fixed supply schedule of Bitcoin is enforced by the distributed network of computers validating the ledger. The value proposition of the fixed inflation schedule is augmented by other properties such as censorship resistance and a design which is resistant to change.

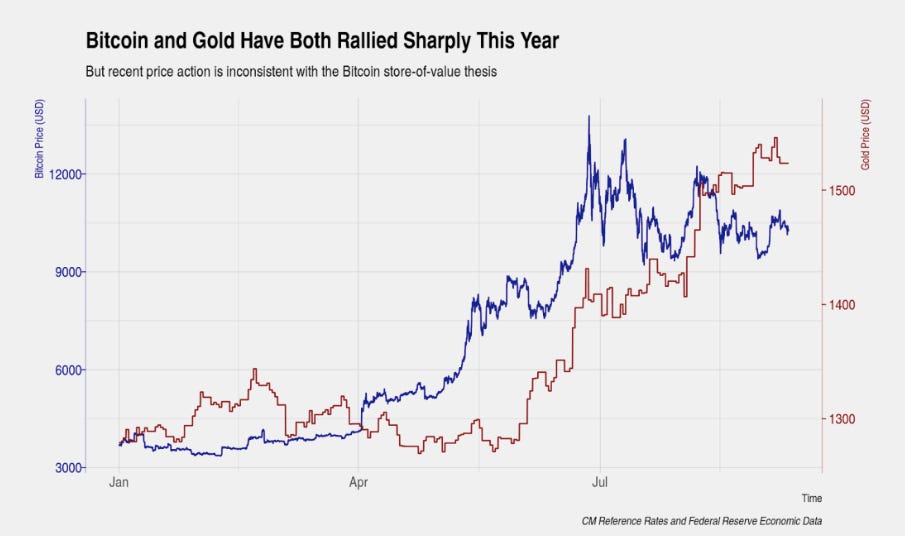

As investors get concerned over growth prospects, they turned to traditional safe-haven assets such as treasury bonds and non-income producing assets like gold and the Japenese Yen. At times this year, Bitcoin has performed similarly to a safe haven asset as it appreciated in line with other safe-haven assets such as gold when signs of economic trouble arise. Both Bitcoin and gold have recorded a strong price performance this year in the midst of concerning economic developments.

Bitcoin Price & Gold Price Year-to-date; Source: CoinMetrics State of the Network

One method for assessing how Bitcoin may perform in times of economic turbulence would be to analyse the past performance of gold during prior recessions which have been mixed. However, this method would be flawed as Bitcoin represents an entirely different value proposition than gold. Although it has strong store-of-value properties, its technological features make it a completely different type of asset. Its historic low levels of correlation with other assets are a reflection of this. James O’Beirne does a great job of highlighting some of the key distinctions between Bitcoin and gold.

“Bitcoin is fully digital bearer asset and as such it has no counterparty risk. Final settlement occurs indisputably within hours, not weeks. The cost of storing it is negligible. Cryptographic features like multisignature schemes and scripting abilities like timelocks enable a trustless programmability that makes it a completely new kind of financial asset, which is basically just a bonus on top of its killer feature: hardness as a money and suitability as a safe-haven asset.”

James O’Beirne

These features serve to make Bitcoin highly suitable as an asset which acts as a hedge against economic turbulence. On top of this, expensive hardware which can only be used for mining Bitcoin expends enormous amounts of computing power to protect the features which the network provides.

An interesting phenomenon in the Bitcoin network is the ability to view how long coins have been dormant since their last movement. This observation is made possible through Bitcoin’s unspent transaction output (UTXO) model. The ability to access this information is impossible in any traditional asset class. This information allows us to partition coins into segments based on how long it has been since they last moved.

The resulting graph, commonly referred to as HODL waves, shows an increasing tendency for investors to hold coins long-term. Over 21% of the current Bitcoin supply has been held for greater than five years. An increasing percentage of bitcoin holders have held their coins between 1 to 2 years with this timeframe band also representing over 21% of all holders. When compared with late 2017 to early 2018, a pronounced decrease has been observed in the lower timeframe bands. Spikes in these bands can often be associated with capitulation and market speculation as investors move their coins to exchanges to liquidate or trade. However, the graphic demonstrates that the current profile of Bitcoin holders is representative of long-term holders with low propensity to sell their holdings. Many of the holders in the 1-2 year timeframe band would have held their coins through the December 2018 lows suggesting that these investors have a low willingness to sell. Circumstances may be different in times of economic turbulence but the current distribution indicates “strong hands” represent a large portion of the Bitcoin market.

Bitcoin UTXO Age Distribution AKA Hodl Waves Superimposed with Bitcoin Price in black; Source: Hodlwave.com

Takeaway 1: Bitcoins’ technological features protected by vast amounts of distributed computing power combined with the tendency of network users to hold coins long-term decrease the possibility that Bitcoin will decline in value in times of economic turbulence but these properties make no strong case for Bitcoin increasing in value either.

Bitcoin’s Safe Haven Narrative

The argument for Bitcoin as a safe haven does not sit well with everyone. Josh Brown, AKA The Reformed Broker, believes Bitcoin’s volatility discredits the argument that the asset could be a safe haven. Brown presents the following two exhibits as his evidence against Bitcoin as a store-of-value or safe haven.

Parker Lewis from Unchained Capital published a great piece addressing Bitcoin’s supposed “volatility problem”. The premise of the post is that volatility and effectiveness as a store-of-value are not mutually exclusive.

The volatility of Bitcoin is a function of its price discovery and is a healthy attribute for an early-stage asset. The volatility of Bitcoin will only decrease as the asset progresses further along its user adoption curve. New waves of adoption currently are orders of magnitude greater than their base before an adoption wave. Parker estimates Bitcoin is currently at less than 1% of terminal adoption. In this case, each new wave of demand would be orders of magnitude greater than the demand level beforehand for many more cycles.

Given Bitcoin’s fixed supply structure, the price needs to find a higher equilibrium point at each new cycle given the disproportionate increase in demand compared to supply. For those familiar with the Econ 101 demand-supply curve, the scenario can be presented as follows.

Theoretical demand-supply curve when Bitcoin reaches maximum supply; Source: Unchained Capital

The demand curve shifts upwards and to the right after each new cycle while the supply curve will shift only slightly to the right with an eventual maximum supply of 21 million. The below graphic shows Parker’s estimates of the disproportionate demand-supply shifts from the last cycle (2016 to 2019) and the resulting impacts on price and market capitalization. It is estimated than the demand increased by a factor of twelve from 2016 to 2019 while supply increased only 10% over the same timeframe.

Demand-supply shifts from the latest market cycle and resulting impacts on price and market capitalization; Source: Unchained Capital

There have also been more detailed studies modelling the scarcity of Bitcoin with its price. Plan B (@100trillionUSD) has published one of the more interesting studies in this area with a regression model looking at the relationship between Bitcoin’s stock-to-flow ratio and it’s price.

Coming back to volatility, Bitcoin is indeed volatile when considered in terms of its USD price. But does its value erode because of this? On the contrary. The volatility Bitcoin exhibits is necessary for the borderless transactions which the network facilitates. To keep its volatility artificially suppressed, the network would need to control the capital flow (i.e. demand) and the supply. This theory is known as the monetary policy trilemma. The trilemma is widely accepted to demonstrate that central banks that issue their own money can only achieve two of three objectives: having a sovereign monetary policy, having free capital flow, and/or having a fixed exchange rate. Bitcoin’s volatility is, therefore, necessary for it to achieve free capital flow and retains an independent monetary policy.

On the other side, instruments which have low volatility are not necessarily good stores of value. The below graph demonstrates the purchasing power of the USD over time.

Building upon this, instruments which have artificially suppressed volatility are often placed in a highly vulnerable state. In Fooled by Randomness, Nassim Taleb describes the Peso problem. During the 1980s, the Mexican Peso exhibited long periods of stability but switched to high levels of volatility sporadically.

“Long periods of stability draw hordes of bank currency traders and hedge fund operators to the calm waters of the Mexican Peso; they enjoy owning the currency because of the high interest rate it commands. Then they “unexpectedly” blow up, low money for investors, lose their jobs, and switch careers”.

Nassim Taleb, Fooled By Randomness

Takeaway 2; Bitcoin’s volatility does not discredit its effectiveness as a store of value or safe haven. On the contrary, the volatility is a natural function of price discovery and is necessary for the network to achieve permissionless payments. Bitcoin’s disproportionate increases in demand combined with its fixed supply schedule suggest that the price of bitcoin will need to continue to adjust upwards for many more adoption cycles to find new price equilibriums. While this does not necessarily relate to an economic crisis, it does make the case for the price of Bitcoin moving upward in the event of a crisis as such events will likely result in Bitcoin receiving more publicity and attention as a potential safe-haven asset which has been evident in the media this year. Such attention and publicity would likely serve to spur user adoption, increasing the demand for the asset.

Sellers Rush to the Door?

An opposing perspective would be that Bitcoin may find selling pressure if an economic crisis takes place. Recessions have often catalyzed selling in gold as investors sell liquid assets on the market to exchange for cash to meet debt obligations. Prices in riskier and illiquid assets drop even further as everyone tries to offload their speculative future returns on these instruments for cash. With Bitcoin considered to be among the riskiest assets and the entire network valued at roughly $0.2 trillion, how would it stand up in the face of such selling pressure? There several reasons why this may not be as big of a concern as it first appears.

Firstly, the development of hardware specialised to mine on the Bitcoin network has evolved into a very important feature of Bitcoin’s design. Those who are procuring the Bitcoin network, miners, have made costly investments in ASIC hardware with the aim of returning a future profit by converting their energy into newly Bitcoin. Such costly investments are essentially a bet on the long-term future of the network and highly disincentive sudden changes. If the ASIC hardware is not used to mine Bitcoin, it becomes worthless. The scope of miners investment also extends far beyond the cost of hardware. Businesses commit capital to land, building data centres specifically tailored for mining bitcoin, and sign 3-5 year power contracts. The huge capital investment which places these fixed assets on the balance sheets of miners translates to billions of dollars in investment which is all tied to the future success of Bitcoin.

Let’s say a certain percentage of miners do panic and want out. We can even consider the extremely unlikely scenario where a large percentage of miners rush to exit. They sell all of their bitcoin on exchanges to other buyers, maybe depressing prices somewhat with their panic. But for their hardware, there only option is to sell to other miners as there is no other use for the hardware. So, let’s say 30% of hardware comes offline by panicked miners looking to sell it. This hardware is redistributed to other miners at depressed hardware prices who bring it back online, having ultimately little impact on the hash rate apart from the temporary drops between exchanges of hardware. Even if the hardware does not come back online, the intelligent design of the difficulty adjustment means the difficulty of mining will drop for remaining miners, increasing their profit margins, and incentivising more miners to come online.

Secondly, institutions are largely responsible for the large sell-offs observed in traditional markets in turbulent. Not only do they represent the majority of the money in these markets, but they also often have risk parameters to oblige which results in all of them rushing to the door at once when things start looking shaky. Ironically, this idea of risk parameters is also what leads them all to pile their balance sheets with dodgy instruments when everything is looking rosy. 2008 was a perfect example of this where the balance sheets of all major banks were loaded with risky instruments that they all had to offload simultaneously when the crisis took place. A lot of these instruments ended up being purchased by governments who in turn placed the debt obligations on the taxpayers. Bringing it back to Bitcoin, while there is some evidence of institutions starting to represent a larger share of the Bitcoin market, they still represent the minority. This implies that the huge onslaught of selling pressure which purges traditional markets when troubles hit with will be far less prevalent in Bitcoin, if not absent entirely.

“institutional ownership of Bitcoin is almost nonexistent at the moment. In a rush for the exit (liquidity), large institutions will be selling off risk assets, but I don't think these institutions have any substantial volume of BTC to sell.”

James O’Beirne, Chaincode Labs Engineer

What about the retail investors that comprise the majority of the market? Will all of these rush to the door to sell? The HODL waves analysis indicates that the majority of the market is comprised of long-term investors. A spike in the shorter term timeframe bands of the HODL waves may certainly be indicative of some investors looking to convert their Bitcoin into fiat but the high percentages currently seen in the longer-timeframe band provides evidence that many holders are looking to hold long-term.

Takeaway 3; Evidence would suggest that there is little risk of a sell-off in Bitcoin as a result of a crisis taking place. The nature of the application-specific hardware in Bitcoin mining means that miners have invested in the long-term health of the Bitcoin network and have little to gain from offloading hardware. Furthermore, institutional investors, which play an important role in the typical market sell-offs observed during turbulent times, still represent a minority of the Bitcoin market. There is evidence that the remaining retail investors are long-term holders and their propensity towards selling would likely be little impacted by a crisis.

The Antifragile Nature of Bitcoin

When the Bitcoin network launched in January 2009, it has been well-documented that the code was marred with bugs. Bitcoin was certainly in an extremely vulnerable position at this time. Any array of attacks could have resulted in the network disappearing into the abyss of the internet forever. A bug introduced to the protocol, a failure to generate sufficient interest, or resistance by the right entities all could have potentially stopped Bitcoin in its tracks early.

Market crashes have led many to write early obituaries for the digital money throughout its ten-year existence. Yet, it still survives and each attack Bitcoin survives makes it stronger. There are still significant risks today. BGP hijacking was noted by Matt Corallo as one of the biggest threats to the network. However, as Bitcoin draws closer to the first economic crisis in its history, its antifragility naturally places it in a stronger position than ever to survive and potentially thrive in times of economic turbulence.

What does this all mean? The fiscal deficits, ominous forward-looking indicators, contracting lagging indicators, trade tensions, political tensions, pile of negative-yielding debt, imbalances in income produced compared to debt service payments, and imbalances in asset risk-reward returns would all typically suggest investors are in for a hard hit, if not a total restructuring of the financial system as we know it today.

However, given that these indicators are all painting a clear picture of turbulent times, the real shock likely lies elsewhere. The biggest hits are always the ones we do not see coming. The very fact that I am writing about all this, and certainly the fact that the mainstream media is writing about all this, indicates that these factors are likely not the real risk. The real risk will likely be second-order effects of how governments and central banks behave in response to these factors. We are likely to see some extremely experimentative methods put in place by governments and central banks to try and micromanage the impending crisis.

Whichever way you slice and dice it, Bitcoin warrants consideration as a hedge against economic turbulence. The empirical evidence is limited and the arguments I have made in this post are certainly speculative. Regardless of this, the network has demonstrated effectiveness in what it sets out to achieve. The limited evidence which does exist suggests there is little downside risk for Bitcoin in the event of a crisis. An argument can be made that a crisis would even benefit Bitcoin as it gains greater publicity as a potential safe-haven which will drive new waves of users to demand the asset. If volatility and the risk associated with Bitcoin’s survival is the concern, exposure could be limited to comfortable levels. Consider that a 5% bitcoin 95% cash portfolio has outperformed stocks for every four-year investment period from 2010 to 2019. However, it’s not all about returns and this is not financial advice. This is simply about the technology which is Bitcoin being an asset that is more detached from the fragilities of the global economy than any other asset which has ever existed.

Thanks to Matt D’Souza CEO of Blockware Solutions for peer-reviewing.

Recommended Reading:

If this topic interests you, here are some of the key resources used in this article for further reading.

The 2s10s Just Inverted: Here’s What Happens Next by Tyler Durden at ZeroHedge

Is the dollar’s “exorbitant privilege” coming to an end? By Craig Cohen at JP Morgan

Bitcoin Is Not Too Volatile By Parker Lewis at Unchained Capital

Antifragile by Nassim Taleb

For financial and crypto content services, contact us here. For research updates, subscribe to our newsletter or RSS. Feel free to get in touch on Twitter.