Bitcoin Cash 51% Attack & On-Chain Analysis With Willy Woo

Exploring the Latest Research and Insights from the Crypto World

You can also read this blog post on the Adaptive Analysis website.

Quick take;

A 51% attack took place on the Bitcoin Cash blockchain and brings the key value proposition of the network into question

Crypto analyst Willy Woo provided insights relating to the cryptocurrency market at a presentation in Bali

BTC.top and BTC.com coordinate a 51% attack on the Bitcoin Cash blockchain

Something big happened recently. A 51% attack was successfully executed on the fourth largest blockchain in the world (by reported market cap figures).

The value proposition of the Bitcoin Cash network is a simple one. On-chain scaling by increasing the maximum block size will result in a more efficient and scalable network.

Increasing the maximum block size does indeed lower fees. The following picture is the typical type of marketing spam that appears on Roger Ver’s (@rogerkver) Twitter account.

You can get even lower fees again by using XRP. Many centralized services will allow you to make value transfers for free.

Nobody disputes that raising the block size lower fees. Those opposed to the idea argue that raising the block size makes an unacceptable tradeoff with the level of security and the degree of decentralization in the network.

And this 51% attack is a loud demonstration of this. When you boil it down, what is the value proposition of a decentralized payment network? Properties such as a distributed network, censorship resistance, and immutability are all tied to the success of Bitcoin and the value it provides.

There were numerous attempts at digital cash prior to Bitcoin but they all had a common vulnerability which led to their ultimate failure. They were overly centralized and subject to the whims of large and powerful entities. Bitcoin’s most sacred property is its degree of decentralization and it justifies the extremely cautious approach that the developers take with the protocol.

But back to Bitcoin Cash. There were some red flags leading up to the 51% attack. For example, one mining entity managed to acquire up to 44% of the hash rate.

The 51% attack itself was relatively simple but has been entangled with complexities. The attack simply consisted of the BTC.top and BTC.com mining pools coordinating a two-block reorg whereby an estimated 3,796 BCH was double spent.

We have reported on this topic with a number of clients that we work with. For a detailed description of the events that happen, refer to this MinerUpdate piece.

Here is a more condensed brief on the events that surrounded the 51% attack.

The first thing to note is that a bug was exploited during an upgrade of the Bitcoin Cash network prior to the occurrence of the 51% attack. The fact that this bug was exploited is not necessarily related but there may be a link.

The bug was present in the protocol far before the upgrade took place but whoever exploited the bug timed it while the upgrade was taking place to cause maximum confusion. The upgrade took place on the 15th of May.

The bug essentially allowed the attacker to put transactions into the Bitcoin Cash memory pool that did not fit the criteria of consensus rules. This served to clog the memory pool and resulted in six empty blocks being mined. There was also an extra block appended to the pre-upgrade version of the Bitcoin Cash network which caused even more confusion.

Once again, this phenomenon is not necessarily related to the 51% attack but a link has been speculated. Let’s move on to the actual attack.

One of the key developments included in the upgrade was the removal of a rule known as CLEANSTACK. This rule made BCH sent to SegWit P2SH addresses unspendable. Essentially, Bitcoin Cash users who sent BCH to such addresses lost access to them.

The removal of the rule would make the BCH accessible to the first miner to append a block whereby this rule was removed. The BCH was to become accessible several hours after the upgrade. Seemingly, there was a consensus among major mining pools that this BCH would be returned to the users that originally sent them but there is a lot of ambiguity surrounding this point.

Several hours after the upgrade took place, a miner with the Coinbase transaction text “unknown” appended a block to the blockchain which sent to an unknown address the BCH that became accessible as a result of the removal of CLEANSTACK. Another block was appended on top of this block and that would be all she wrote in the normal world of immutable decentralized network payments.

However, BTC.top and BTC.com coordinated a two-block reorganization of the blockchain to orphan the block mined by “unknown” and also the block appended on top of this. The reorganized blockchain quickly became the chain representing the longest proof-of-work.

Only 111 of the 137 transactions included in the block mined by “unknown” made it into the final chain. It is estimated that 3,796 BCH was double spent. An analysis of the event by Coinbase states that the BCH was returned to the users that originally sent it to the SegWit P2SH addresses.

There were mixed reactions regarding the attack. Coinbase applauded the ability of the mining pools to return the funds to users. BitMEX research sees it as setting a bad precedent and believes it may even lead to some considering similar scenarios on Bitcoin.

The market cared little and the impact on the valuation of Bitcoin Cash was negligible. The event was quickly brushed past. My personal thesis is the crypto market is still in early days and its participants don’t realise what the true value propositions of decentralized protocols are. The market is still largely driven by speculation. Hence, valuations of hundreds of millions on utility tokens with no utility.

The reversal of payments by large centralized entities undermines the core principles of a decentralized network. Decentralized networks are meant to be resistant to the whims of large entities. As the market matures and the wheat separates from the chaff, I believe we will see huge downward adjustments in the valuation of those networks which can’t protect the core value propositions that decentralized networks provide.

On-Chain Analysis With Willy Woo

It wasn’t so long ago that I read a BreakerMag article where the author delivered a long-form piece that detailed his experiences going to see crypto data analyst Willy Woo present in Ubud, Bali. After relocating to Bali in March, I assumed I missed my chance to see Willy present but the mysterious pseudonymous man made a reappearance yesterday evening to present in the same place on the 5th of June. I made the long but beautiful moped journey to Ubud which was scattered with scenic views.

Willy’s presentation was centred around on-chain analysis and strategies to gain alpha (above the normal return of the market). Metrics such as NVT and Realized Value were discussed but information on such metrics is easily found online in much detail through sources such as woobull.com, Coinmetrics.io, and messari.io.

The value of attending events is capturing the little insights that happen as the presenter ponders the information they are sharing while synergising with the questions and energy of the audience. Willy was definitely a deep (and relaxed) thinker and here are some of the points discussed above and beyond data metrics.

Please note that all of this is based on my recollections and rough notes from the event. The accuracy of my recollection is subject to the flaws of the normal data-processing unit we call humans. Therefore, please take this as a more general note of what Willy discussed in the presentation as opposed to an exact description.

Retail is always wrong. There is too much money to be made by big whales betting against small fish for them not to do it. When all the small fish are short, the whales are incentivised to push the market up and vice versa. If most of the market is short and a big player pushes the price up, this catalyzes a cascade of buying pressure as those with short positions either have to get long to close their position or are liquidated which also results in a long position. Such events can result in sharp price movements and there is serious money to be made by whales determining where most of the market have their positions. The most recent example of this is when the whole market taught price increases in bitcoin were going to reverse as it approached ~$6000 but the price quickly spiked through. Such rapid movements are the result of cascades of longs and liquidations being executed. For the smaller player, a viable strategy is anticipating what way the big players are going to move the market and riding along. Bitfinex longs and shorts and the BitMEX funding rate can be used to assess what way most of the market is betting.

10% of daily trading volume gets you a seat at the table. Willy talked about a month where he spent the entire time trading one market. I believe the market he traded was an altcoin BTC market. Regardless, by the end of the month, Willy came to the conclusion that the market was essentially being controlled by five major players. These are the above noted big players in “retail is always wrong”. Willy referred to being one of these whales as “having a seat at the table”. An account size of 10% of daily trading volume in a market gets you a seat at the table. An account size of 5% of daily traded volume gives you a host of market manipulation tactics you can employ.

Quant funds. The big players in the bitcoin market are quant funds. These players entered the bitcoin market in 2017 when the market became big and liquid enough to attract these players.

A Wall Street story. Willy referred to a story by Travis Kiling (@Travis_Kling) who used to work on Wall Street. The institutional investors are the bullies in the schoolyard. The retail investor shows up to the schoolyard with his lunch money. The bullies smash the kid and take his lunch money.

Utility token model is broken. Utility tokens valued in the hundreds of millions is nonsensical. The market is not aware of how outrageous the valuations of these tokens are. An example was given that if all the cloud storage customers of Amazon transitioned to use decentralized cloud storage on Storj, the valuations would still not be justified. Augur was also referred to where it raised millions on the basis of promises and took three years to launch a product which now has approximately 100 daily users. The magnitude of typical utility token fundraises are not seen in the venture capital world unless startups have a track record of about four years of exponential growth.

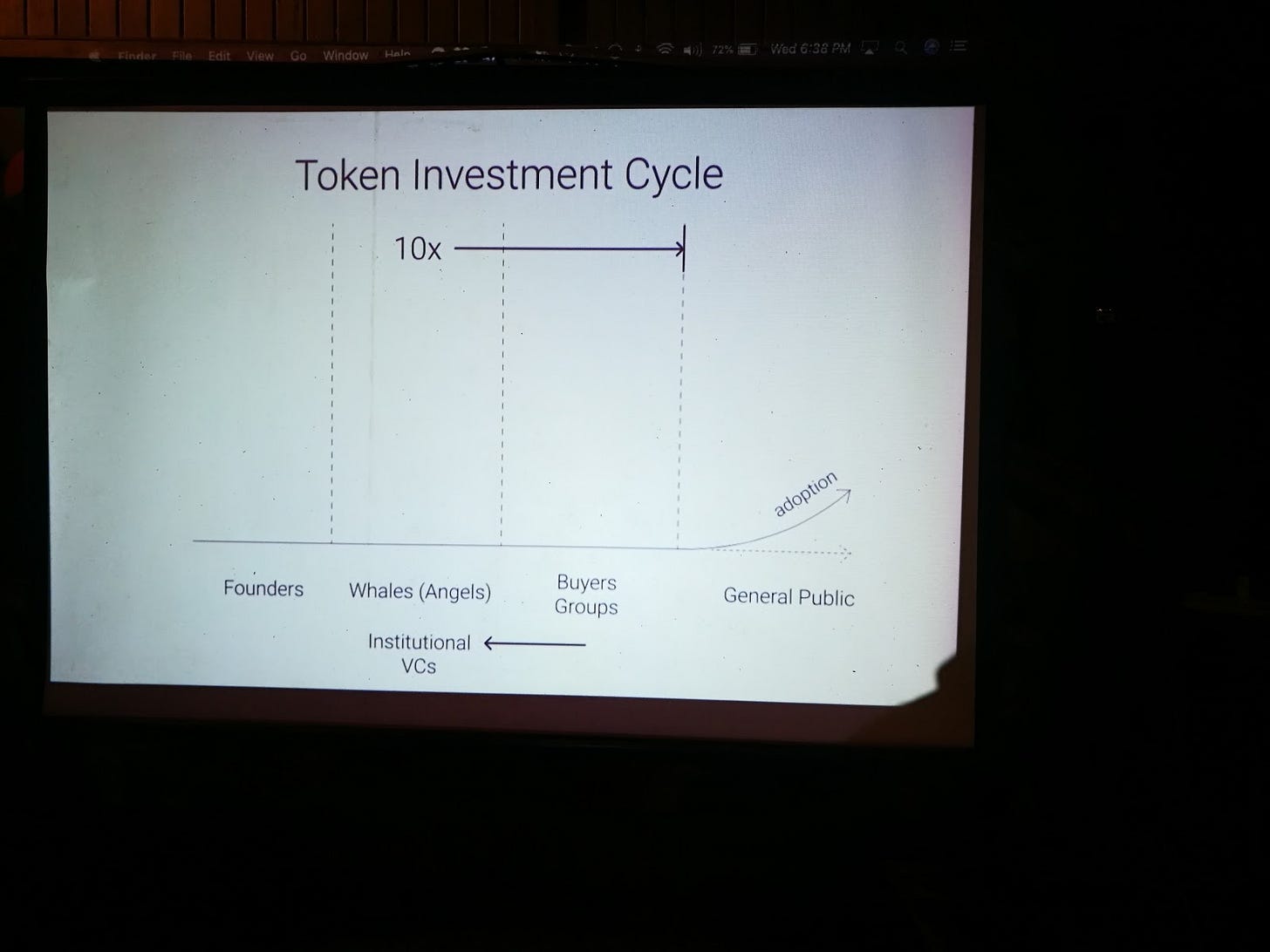

The order of money. In traditional markets, the smart money (early innovators, institutions, and sovereigns) get in prior to the retail investor. Regulations prevent the retail investor from getting in early and these players can only get their piece of the action when a company hits the public markets. The very systems that prevent retail investors from getting exposure to private companies prevented institutions from getting exposure to cryptocurrency. The institutions had strict regulations to comply with and could not simply have a speculative asset such as a cryptocurrency on their balance sheet. This allowed retail investors to enjoy an earlier and bigger slice of the pie while regulations are only catching up now to make the market accessible to institutions.

To make the situation for utility tokens even worse, they have reversed this order back to the way it originally was. These token fundraises have offered huge discounts to whales and institutions while letting public retail investors purchase at the highest possible price.

The Gold market. Willy noted concerns regarding the future of the Bitcoin market. Similar to how the gold market is controlled by banks, there is the possibility that the Bitcoin market could be controlled by those who hold disproportionately large amounts. However, at the moment, the whales are libertarians whose key agenda is to change the world.

For financial and crypto content services, contact us here. For research updates, subscribe to our newsletter or RSS. Feel free to get in touch on Twitter.